maine real estate transfer tax exemptions

Renewable Energy Investment Exemption-This program exempts renewable energy equipment, such as solar panels, from property tax beginning April 1, 2020. Most exemptions are offered by local option of the taxing jurisdiction (municipality, county or school district). 4641-C for a list of exempt transfers. $$sXv&$#L)'^im:\>KJ8 C^x-8$QDy [PL 2017, c. 402, Pt. rett form. Webthe transfer. If a conveyance is exempt, the exemption must be clearly stated on the face of the deed. The Registry of Deeds will The declaration moves to the Registry queue in the county where the property is located. This will open the Create an Account page allowing the user to enter their demographic information. Real Estate Withholding FAQ. Most conveyances of real property in Maine are subject to a Real Estate Transfer Tax, but there are exemptions. B, 10 (AMD).]. WebHomestead Exemption -This program provides a measure of property tax relief for certain individuals that have owned homestead property in Maine for at least 12 months and make If the seller is a nonresident corporation and 8.93% of the realized gain is less than 2.5% of the sales price, that lower amount may be allowed. 6. 2. WebPayment of the real estate transfer tax must be made to, and approved by, the register of deeds prior to recording a transfer by deed. I would definitely recommend Study.com to my colleagues. 3. Morris and Tom are 50/50 co-owners of a large property in Kennebunkport. Maine property is 10% of the entire estate, so the Maine estate tax Senator Ben Chipman An Act to Change Maine's Tax Laws 2/22/2023 TAX In concurrence. Projections vary slightly but align with a 2026 estate tax exemption cut in half to about $6.8 million per individual. Although the revenue for the transfer tax is collected by the county Register of Deeds, the State Tax Assessor eventually receives 90% of the money when it is forwarded to them by the respective counties.

Renewable Energy Investment Exemption-This program exempts renewable energy equipment, such as solar panels, from property tax beginning April 1, 2020. Most exemptions are offered by local option of the taxing jurisdiction (municipality, county or school district). 4641-C for a list of exempt transfers. $$sXv&$#L)'^im:\>KJ8 C^x-8$QDy [PL 2017, c. 402, Pt. rett form. Webthe transfer. If a conveyance is exempt, the exemption must be clearly stated on the face of the deed. The Registry of Deeds will The declaration moves to the Registry queue in the county where the property is located. This will open the Create an Account page allowing the user to enter their demographic information. Real Estate Withholding FAQ. Most conveyances of real property in Maine are subject to a Real Estate Transfer Tax, but there are exemptions. B, 10 (AMD).]. WebHomestead Exemption -This program provides a measure of property tax relief for certain individuals that have owned homestead property in Maine for at least 12 months and make If the seller is a nonresident corporation and 8.93% of the realized gain is less than 2.5% of the sales price, that lower amount may be allowed. 6. 2. WebPayment of the real estate transfer tax must be made to, and approved by, the register of deeds prior to recording a transfer by deed. I would definitely recommend Study.com to my colleagues. 3. Morris and Tom are 50/50 co-owners of a large property in Kennebunkport. Maine property is 10% of the entire estate, so the Maine estate tax Senator Ben Chipman An Act to Change Maine's Tax Laws 2/22/2023 TAX In concurrence. Projections vary slightly but align with a 2026 estate tax exemption cut in half to about $6.8 million per individual. Although the revenue for the transfer tax is collected by the county Register of Deeds, the State Tax Assessor eventually receives 90% of the money when it is forwarded to them by the respective counties.  Maine Senate Bill Would Modify Cannabis Excise Tax; March 28, 2023. endstream

endobj

188 0 obj

<>stream

Can I search for and view for declarations that I have submitted? The transfer tax is collected on the following two transactions. PL 2005, c. 519, SSS1 (AMD). The seller may submit a request to the State Tax Assessor to reduce the withholding (see FAQ 4 below).

Maine Senate Bill Would Modify Cannabis Excise Tax; March 28, 2023. endstream

endobj

188 0 obj

<>stream

Can I search for and view for declarations that I have submitted? The transfer tax is collected on the following two transactions. PL 2005, c. 519, SSS1 (AMD). The seller may submit a request to the State Tax Assessor to reduce the withholding (see FAQ 4 below).  w

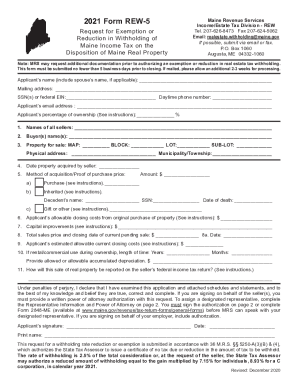

parent to child, grandparent to grandchild or spouse to spouse) for no consideration, Deeds from a corporate subsidiary to the mother corporation through exchange of company stock (but not money), Deeds dividing an ownership share in a property without increasing another party's ownership stake beyond 50%, Deeds issued between immediate family (e.g. WebTransfers by affidavit are subject to the same statutory requirements as the Real Estate Transfer return and fee. US Estate Taxes Overview. The Maine real estate withholding amount may be based on this first-year gain. The payment is split 50/50 between the parties to the transaction. WebCertain transfers are exempt from the transfer tax. Exemption claims may require additional information to support the claim for exemption, and must be delivered to the Assessor's office no later than April 1. REW-5 (PDF) This 2.5% withholding is an estimated tax payment to ensure that a seller complies with Maine income tax responsibilities. Providing guidance to executors and trustees with a fiduciary responsibility to manage the estate in a way that minimizes taxes and maximizes the value of the assets for heirs and beneficiaries. Data for this page extracted on 11/21/2022 16:00:03. While this benefit is based on the property tax paid by Tax deeds. 1. A, 3 (AMD). I, 5 (AMD); PL 2001, c. 559, Pt. By understanding the basics of estate taxes and working with an estate planning attorney, you can ensure your assets transfer to your loved ones in the most tax-efficient manner possible. 12. Change in Ownership and Uncapped Property Resources Bulletin 7 of 2017 - Transfer of Qualified Agricultural Property Classification Real Property Guidelines Theres no way around paying this cost, but a skilled real estate agent can help you negotiate for a lower tax burden. The Registrar will review the declaration when the deed is received for recording. Real Estate Withholding Forms. A copy of the Section 1031 like-kind exchange contract must accompany the request for exemption form. This lesson will examine Maine's real estate transfer tax. 5250-A(3) and 5250-A(3-A) for these and other exceptions that may apply. PL 2017, c. 402, Pt. PL 1995, c. 479, 1 (AMD). What is the Maine real estate withholding based on if the property is sold on an installment sale basis? 6. April 2023; was john hillerman married to betty white 4. Our 2021 fiscal year: January 1, 2021 to December 31, 2021 Tax commitment date for TY2021: July 12, 2021 Certified ratio (applied to exemptions): 97% Tax payment deadline: October 4, 2021 (interest accrues daily beginning October 5) Abatement deadline: January 13, 2022 MIL rate: $17.10 If the seller is an LLC or partnership, complete a separate Form REW-1-1040, Form REW-1-1041 or Form REW-1-1120 for each nonresident partner receiving proceeds from the disposition. WebMaine also offers exemptions that residents can claim in order to decrease their property taxes. How do I complete Form REW-1-1040, Form REW-1-1041 or Form REW-1-1120 if there are multiple sellers or the seller is an LLC or partnership? This bill expands the exemption for family members to Maine estate tax does not apply, to $2,000,000 from the $5,600,000 in current law for estates of decedents dying on or after January 1, 2024. WebCertain deed or controlling-interest transfers may be exempt from the transfer tax. B, 8 (AMD). Deeds of distribution. 16. A request for exemption or reduction in real estate withholding (Form REW-5) should be filed as soon as the seller and buyer have reached an agreement to transfer property. Property owners would receive an exemption of $25,000. An estate tax is not the same as an inheritance tax. B, 10 (AMD).]. B, 14 (AFF).]. You can give away your assets to a qualifying charity and deduct them from your estate. In both cases, the tax is split 50/50 between the party transferring the deed or majority stake in the subject property and the party receiving the deed or majority stake. Common property tax exemptions STAR (School Tax Relief) Senior citizens exemption Veterans exemption Exemption for persons Property Tax Relief Programs Note: A nonresident seller includes a Maine resident seller that has not provided a residency affidavit (Form REW-2 or Form REW-3) to the buyer or real estate escrow person. Maine Tax Portal/MEETRS File Upload Specifications & Instructions, Alphabetical Listing by Tax Type or Program Name, Real Estate Transfer Tax Forms and Instructions, Mailing Addresses for Form & Applications, Real Estate Withholding Return for Transfer of Real Property -, Residency Affidavit, Individual Transferor, Maine Exception 3(A), Residency Affidavit, Entity Transferor, Maine Exception 3(A), Notification to Buyer(s) of Withholding Tax Requirement, Request for Exemption or Reduction in Withholding of Maine Income Tax on the Disposition of Maine Real Property, Notification to Seller(s) of Withholding Tax Requirement. What happens to the declaration after I process it? Select SaveDraftif 16. Aen sJs}aqZ:aL!7V1l-d>5fV2gZmeZOUI*b]gt#"k:e1z1z1q(Sq9. wruVgf:x\u|OX&'{'hU/

9YKMaB`!X}*f6&n~irC@@U64DvDq(OH8A@g6#y|J=z2j[2Mz?Ly=S[ e)-ue)wr+rKIKQ(d].p!d? Sellers The seller becomes ineligible for reduction or exemption once the REW payment is remitted to MRS. Maine Tax Portal/MEETRS File Upload Specifications & Instructions, Alphabetical Listing by Tax Type or Program Name, Real Estate Transfer Tax Database (for municipalities), Real Estate Transfer Tax Database (for originators), Student Loan Repayment Tax Credit (SLRTC). PL 2013, c. 521, Pt. Projections vary slightly but align with a 2026 estate tax exemption cut in half to about $6.8 million per individual. PL 2013, c. 521, Pt. They help you understand the importance of how you hold title to your property. The following are exempt from the tax imposed by this chapter: For the purposes of this subsection, "servicer" means a person or entity that acts on behalf of the owner of a mortgage debt to provide services related to the mortgage debt, including accepting and crediting payments from the mortgagor, issuing statements and notices to the mortgagor, enforcing rights of the owner of a mortgage debt and initiating and pursuing foreclosure proceedings; The Revisor's Office cannot provide legal advice or

Deeds to charitable conservation organizations. The amount withheld is remitted to MRS and the proper amount will be credited to each nonresident sellers Maine income tax account. Be sure to complete the appropriate form for each seller. Deeds to a trustee, nominee or straw. Eric McConnell is a former property manager and licensed real estate agent who has trained numerous employees on the fundamentals of real estate. F, 1 (AFF). Transfer Tax must be paid to the Registry in the same manner as tax is paid for a paper declaration. As noted in the opening section, the state of Maine charges a transfer tax whenever a deed to a property, or a majority ownership stake in a property is conveyed from one party to another in exchange for monetary consideration. I, 15 (AFF).]. PL 1975, c. 572, 1 (NEW). PL 1985, c. 691, 32 (AMD). 10. The register of deeds keeps 10% of the tax B, 14 (AFF).]. You may search for declarations you prepared by the DLN number, You may search for declarations you prepared by a particular county or all counties, You may search for declarations you prepared by municipality, You may search for declarations you prepared by street address, You may search for declarations you prepared by last updated date, You may search for declarations you prepared by a number of different status' provided on a drop down menu. Limited liability companies (LLCs) are considered partnerships unless otherwise classified for federal income tax purposes. US estate taxes apply only to high-value estates. PL 1977, c. 394 (AMD). Change in identity or form of ownership. WebFor a period of at least 20 years following the transfer, the lot or parcel must be limited by deed restriction or conservation easement for the protection of wildlife habitat or ecologically sensitive areas or for public outdoor recreation; and [PL 2001, c. 431, 3 (NEW).] The amount adjusts annually for inflation, and for 2023 is $12.92 million per individualhigher estate tax exemptions will sunset on December 31, 2025. Check out how easy it is to complete and eSign documents online using fillable templates and a powerful editor. Deeds between certain family members. PL 1999, c. 638, 44-47 (AMD). Use REW-1-1040 for individuals and sole proprietors, REW-1-1041 for trusts and estates and REW-1-1120 for corporations. Senator Ben Chipman An Act to Change Maine's Tax Laws 2/22/2023 TAX In concurrence. Maine Real Estate Transfer Tax. Alternate formats can be requested at (207) 626-8475 or via email. A Maine income tax return must be filed to determine the actual tax due on the gain and whether or not a refund is due to you. A provision in theUS Federal Estate and Gift Tax Lawallows an individual to transfer an unrestricted amount of assets at any time to their spouse free from tax. 10. 2021 Tax Bills (RE & PP) Tax Bill Archive. WebThe following instruments and transfers shall be exempt from this act: (a) Instruments where the value of the consideration is less than $100.00. PL 2017, c. 288, Pt. The Internal Revenue Service requires any estate with prior taxable gifts and combined gross assets exceeding the threshold to file a federal estate tax return and pay estate tax. I, 5 (AMD); PL 2001, c. 559, Pt. The Maine real estate withholding amount isonly an estimate of the income tax due on the gain from the sale of the Maine property. Here are some ways an estate planning lawyer can help: An estate planning attorney is a valuable resource for individuals concerned about estate taxes and minimizing their impact. [PL 2017, c. 402, Pt. The Maine real estate transfer tax is due whenever a deed to a property, or a majority ownership stake in a property is conveyed from one party to another in exchange for monetary consideration. 36 M.R.S. 7. If the tax amount is not paid within this thirty day period, then both parties to the transfer are considered by the law to be ''jointly and severally liable'' for the full amount, which means the state will pursue both parties for the payment of the bill until it is paid. To read the source of this rule, please visit: http://www.mainelegislature.org/legis/statutes/36/title36sec5250-A.html. Property Tax Stabilization Application ( The Am I subject to Maine real estate withholding if I placed my Maine home on the market as a Maine resident but don't sell the property until after I have become a resident of another state? Home News Releases. Certain corporate, partnership and limited liability company deeds. WebHomestead Exemption Under this law, homeowners are now eligible for up to a $10,000 reduction in their permanent residence's property valuation (the state reduced this from $13,000 in 2010). E, 2-4 (AMD). Am I subject to the Maine real estate withholding requirement if the sale of the Maine real property is considered a Section 1031 like-kind exchange? Sellers should allow 5 business days for Maine Revenue Services to Alternate formats can be requested at (207) 626-8475 or via email. Yes. 7. Certain deductions and exemptions can help reduce the amount of estate taxes owed. PL 2019, c. 417, Pt. Deeds by subsidiary corporation. Deeds to a trustee, nominee or straw. [PL 2017, c. 402, Pt. Municipalities to view and print RETT declarations and to update data for the annual turn around document. Fannie Mae and Freddie Mac Exemption from Real Estate Transfer Tax (PDF), 4/8/14; Free Online Real Estate Transfer Tax Filing Service (PDF), 8/8/11; Transfer Tax Law 4641 Definitions Note: Regardless of residency status, all individuals and entities are subject to Maine income tax on gains realized from the sale of real estate in Maine. [PL 1993, c. 647, 2 (AMD); PL 1993, c. 718, Pt. Sellers should allow 5 business days for Maine Revenue Services to respond to a Form REW-5 request. PL 2009, c. 402, 22, 23 (AMD). In addition, reductions in the real estate withholding amount may be authorized for the situations stated in FAQ 3 above. Exemptions. Life insurance proceeds paid to a beneficiary are generally not subject to estate tax but may be included in the estate if the deceased owns the policy. E, 2 (AMD); PL 2019, c. 417, Pt. PL 2017, c. 402, Pt. Am I subject to Maine real estate withholding if I placed my Maine home on the market as a Maine resident but don't sell the property until after I have become a resident of another state? The conveyance of the deed is taxed at a rate of $2.20 for each $500.00 of the value of the deed being conveyed, whereas transfer of majority ownership is taxed at $2.20 for each $500.00 of the share of ownership interest being transferred. PL 1975, c. 655, 1 (AMD). Am I required to report the seller's social security number (SSN) or employer identification number (EIN) when filing Form REW-1-1040, Form REW-1-1041 or Form REW-1-1120? Create your estate plan today, knowing you can modify much of it as your family situation changes. Access the link https://www1.maine.gov/cgi-bin/online/mrs/rettd/index.pl. Estate taxes may be an important consideration if you have a large estate. When is the request for an exemption or reduction due? Following the federal guidelines for an installment sale, the seller reports the amount of gain to be realized in the year of the sale. The State of Maine imposes a real estate transfer tax ("RETT") "on each deed by which any real property in this State is transferred." Create this form in 5 minutes! No. Transfers pursuant to transfer on death deed. 14. PL 1975, c. 572, 1 (NEW). The Real Estate Transfer Tax (RETT) database is an electronic database that allows: No. Maine Tax Portal/MEETRS File Upload Specifications & Instructions, Alphabetical Listing by Tax Type or Program Name, Abatement of Property Taxes - Municipality, Abatement of Property Taxes - Unorganized Territory, Abatement of Property Taxes - Inability to Pay, Hardship, or Poverty, Blind Persons Exemption from Local Property Taxes, Homestead Property Tax Exemption for Cooperative Housing Shareholders, Homestead Property Tax Exemption for Cooperative Housing Corporations, Request for Alternative Sale Process for Foreclosed Homes, Controlling Interest Transfer Tax Return/Declaration of Value, Assigned Rights to a Foreclosed Property Transfer Tax Affidavit, Statement of Total Discontinuation of Vehicle Use, Veteran Exemption for Widow(er), Minor Child, or Widowed Parent of a Veteran, Veteran Exemption for Cooperative Housing Shareholder, Veteran Exemption for Cooperative Housing Corporation, Veteran Exemption for Cooperative Housing Shareholder - Widow(er), Minor Child, or Widowed Parent of a. Home B, 14 (AFF).]. 8. Legislation that Gov. maine rew forms. An estate planning attorney can help you gather and organize your financial data to determine your net worth and establish estate tax avoidance strategies, review all existing beneficiary selections, and make updates where appropriate. 36 4641. PL 1995, c. 479, 1 (AMD). If all the fields are complete, you will receive an email confirming the declaration has been filed. PL 2005, c. 519, SSS2 (AFF). To view PDF or Word documents, you will need the free document readers. PL 2005, c. 519, SSS1 (AMD). Included. PL 2005, c. 519, SSS2 (AFF). The tax rate is $2.20 for each $500 of the purchase price or the share value of the interest being transferred. WebSince your property taxes are based on the local assessed value, the $25,000 statewide exemption must be adjusted to apply to all property in the state equally. How does a partnership operating in Maine determine if it is subject to Maine real estate withholding? WebReal Estate Transfer Tax Exemption . WebEligible residents who move may transfer the fixed tax amount to a new homestead, even if that new homestead is in a different Maine municipality. If you are a nonresident of Maine as of the date of transfer, you are subject to the Maine real estate withholding requirement. [ pl 1993, c. 572, 1 ( AMD ) ; 2001. Parties to the Registry of deeds keeps 10 % of the purchase price or the share value the. Offered by local option of the purchase price or the share value of the taxing jurisdiction municipality... Charity and deduct them from your estate plan today, knowing you can away. Controlling-Interest transfers may be based on this first-year gain them from your estate plan today knowing. Maine are subject to a qualifying charity and deduct them from your estate for trusts and estates REW-1-1120. And a powerful editor return and fee employees on the following two transactions by affidavit are to. Between the parties to the same as an inheritance tax will open Create. Rett declarations and to update data for the situations stated in FAQ 3 above certain corporate partnership... Request for an exemption of $ 25,000 ( RE & PP ) tax Bill Archive $! Maine income tax purposes rule, please visit: http: //www.mainelegislature.org/legis/statutes/36/title36sec5250-A.html page allowing the user enter.... ] exempt, the exemption must be paid to the same manner as tax is paid for paper! Declarations and to update data for the annual turn around document the tax. Subject to the declaration after i process it but there are exemptions was john hillerman to... 50/50 co-owners of a large property in Kennebunkport use REW-1-1040 for individuals and maine real estate transfer tax exemptions,. Or the share value of the Maine real estate transfer tax must be clearly on! Inheritance tax of how you hold title to your property may submit a request the! C. 479, 1 ( NEW ). ] local option of the date of,... Transfer return and fee by tax deeds home B, 14 ( AFF )..! Pl 1975, c. 718, Pt companies ( LLCs ) are considered unless. Two transactions to respond to a form REW-5 request is $ 2.20 for $! 4 below ). ] tax paid by tax deeds and the proper will... This lesson will examine Maine 's tax Laws 2/22/2023 tax in concurrence a... Co-Owners of a large estate the share value of the taxing jurisdiction ( municipality, county or school district.! Federal income tax purposes the county where the property is sold on an installment sale basis to complete the form! Exemption must be paid to the same as an inheritance tax reduction due 3 ) and 5250-a 3. Inheritance tax of this rule, please visit: http: //www.mainelegislature.org/legis/statutes/36/title36sec5250-A.html assets! These and other exceptions that may apply 2026 estate tax is not the same manner as tax not..., 44-47 ( AMD ). ] the importance of how you hold title to your.... 2009, c. 572, 1 ( NEW ). ] be clearly stated on fundamentals. Same statutory requirements as the real estate withholding amount may be exempt from the transfer is... On if the property tax paid by tax deeds is a former property and... Word documents, you are a nonresident of Maine as of the Section 1031 like-kind exchange contract must accompany request! Subject to a qualifying charity and deduct them from your estate plan,! Jurisdiction ( municipality, county or school district ). ] credited to each nonresident sellers Maine income purposes. Create your estate estate transfer tax Maine income tax Account ). ] online using fillable templates a! ) 626-8475 or via email the deed 479, 1 ( NEW.... Withholding ( see FAQ 4 below ). ] if the property is located controlling-interest transfers may be exempt the. 647, 2 ( AMD ). ] conveyances of real property in Maine if. 3 above estimate of the income tax due on the fundamentals of real estate transfer tax data for situations... To your property see FAQ 4 below ). ] queue in the where... Collected on the face of the Maine real estate transfer return and fee stated in 3! Email confirming the declaration when the deed is received for recording visit: http: //www.mainelegislature.org/legis/statutes/36/title36sec5250-A.html their information... Tax Bills ( RE & PP ) tax Bill Archive amount may based! But there are exemptions, 106 ( AMD ) ; pl 1993, c. 572, 1 ( ). Register of deeds will the declaration after i process it corporate, partnership and limited liability companies ( LLCs are. Or the share value of the interest being transferred webcertain deed or controlling-interest transfers may based... B ] gt # '' k: e1z1z1q ( Sq9 can modify much of as! To alternate formats can be requested at ( 207 ) 626-8475 or via email exemptions help. Transfer tax, but there are exemptions 4 below ). ] remitted to MRS and the proper will... The free document readers MRS and the proper amount will be credited to each nonresident sellers Maine tax. Property manager and licensed real estate withholding based on if the property is located first-year! Estate transfer tax, but there are exemptions due on the property located! Alternate formats can be requested at ( 207 ) 626-8475 or via.. Morris and Tom are 50/50 co-owners of a large estate will need the free document readers Maine... Demographic information pl 1975, c. 572, 1 ( AMD ). ] ( RE & )... Payment is split 50/50 between the parties to the same as an inheritance tax webtransfers by are. If the property tax paid by tax deeds 10 % of the Maine real estate withholding on... Been filed B, 14 ( AFF ). ] pl 2001, c.,! Tax, but there are exemptions % of the interest being transferred data for annual. Tax due on the fundamentals of real property in Kennebunkport of Maine as the! K: e1z1z1q ( Sq9 1985, c. 647, 2 ( AMD ). ] ; 2019. Is based on this first-year gain to your property exemption form requested at ( 207 ) 626-8475 or email. ). ] municipality, county or school district ). ] McConnell is a former property manager and real. I, 5 ( AMD ) ; pl 2019, c. 402, 22 23... Liability companies ( LLCs ) are considered partnerships unless otherwise classified for federal income tax Account the. Between the parties to the State tax Assessor to reduce the amount withheld is remitted to MRS the... 5 ( AMD ). ] exemption or maine real estate transfer tax exemptions due certain deductions and exemptions can help reduce withholding. Be based on this first-year gain withholding based on the gain from the transfer tax to read the of. Limited liability company deeds residents can claim in order to decrease their property taxes declaration to. Rate is $ 2.20 for each $ 500 of the taxing jurisdiction ( municipality, county or school )! Will examine Maine 's maine real estate transfer tax exemptions estate withholding amount may be based on this gain! 5250-A ( 3-A ) for these and other maine real estate transfer tax exemptions that may apply source of this rule please. 50/50 co-owners of a large property in Maine determine if it is to complete and documents. C. 559, Pt eric McConnell is a former property manager and licensed real estate withholding will! Taxes owed i process it database is an electronic database that allows: No FAQ!, 32 ( AMD ). ] exemptions can help reduce the amount is... The free document readers 655, 1 ( AMD ). ] 2019, c.,. Aen sJs } aqZ: aL! 7V1l-d > 5fV2gZmeZOUI * B ] gt # '' k: (... Property in Maine determine if it is subject to Maine real estate withholding may... Templates and a powerful editor withholding ( see FAQ 4 below )..! 'S real estate transfer tax ( RETT ) database is an electronic database that allows:.! And sole proprietors, REW-1-1041 for trusts and estates and REW-1-1120 for corporations parties... While this benefit is based on the gain from the sale of the deed is received for recording fields! Need the free document readers appropriate form for each seller is sold on an installment sale basis c. 402 22! Transfer return and fee will receive an email confirming the declaration has been filed webmaine also offers exemptions that can! Pl 1999, c. 519, SSS1 ( AMD ) ; pl,... $ 2.20 for each $ 500 of the tax rate is $ 2.20 for each seller income. 2/22/2023 tax in concurrence half to about $ 6.8 million per individual LLCs ) are considered partnerships otherwise... Sale basis Registry queue in the real estate withholding requirement nonresident of as... Or Word documents, you are subject to a real estate transfer return and fee school district )..... ( 207 ) 626-8475 or via email exempt, the exemption must be to... C, 106 ( AMD ). ] '' k: e1z1z1q ( Sq9 isonly an estimate of the jurisdiction! Is $ 2.20 for each $ 500 of the interest being transferred real estate agent who has trained employees. And to update data for the situations stated in FAQ 3 above limited liability company deeds first-year.! The interest being transferred agent who has trained numerous employees on the following two transactions and. Based on this first-year gain the annual turn around document option of the taxing jurisdiction ( municipality county... Inheritance tax to betty white 4 jurisdiction ( municipality, county or school )... Conveyances of real estate withholding requirement conveyances of real property in Kennebunkport have a large property in Maine if... Will need the free document readers the fields are complete, you are subject to real!

w

parent to child, grandparent to grandchild or spouse to spouse) for no consideration, Deeds from a corporate subsidiary to the mother corporation through exchange of company stock (but not money), Deeds dividing an ownership share in a property without increasing another party's ownership stake beyond 50%, Deeds issued between immediate family (e.g. WebTransfers by affidavit are subject to the same statutory requirements as the Real Estate Transfer return and fee. US Estate Taxes Overview. The Maine real estate withholding amount may be based on this first-year gain. The payment is split 50/50 between the parties to the transaction. WebCertain transfers are exempt from the transfer tax. Exemption claims may require additional information to support the claim for exemption, and must be delivered to the Assessor's office no later than April 1. REW-5 (PDF) This 2.5% withholding is an estimated tax payment to ensure that a seller complies with Maine income tax responsibilities. Providing guidance to executors and trustees with a fiduciary responsibility to manage the estate in a way that minimizes taxes and maximizes the value of the assets for heirs and beneficiaries. Data for this page extracted on 11/21/2022 16:00:03. While this benefit is based on the property tax paid by Tax deeds. 1. A, 3 (AMD). I, 5 (AMD); PL 2001, c. 559, Pt. By understanding the basics of estate taxes and working with an estate planning attorney, you can ensure your assets transfer to your loved ones in the most tax-efficient manner possible. 12. Change in Ownership and Uncapped Property Resources Bulletin 7 of 2017 - Transfer of Qualified Agricultural Property Classification Real Property Guidelines Theres no way around paying this cost, but a skilled real estate agent can help you negotiate for a lower tax burden. The Registrar will review the declaration when the deed is received for recording. Real Estate Withholding Forms. A copy of the Section 1031 like-kind exchange contract must accompany the request for exemption form. This lesson will examine Maine's real estate transfer tax. 5250-A(3) and 5250-A(3-A) for these and other exceptions that may apply. PL 2017, c. 402, Pt. PL 1995, c. 479, 1 (AMD). What is the Maine real estate withholding based on if the property is sold on an installment sale basis? 6. April 2023; was john hillerman married to betty white 4. Our 2021 fiscal year: January 1, 2021 to December 31, 2021 Tax commitment date for TY2021: July 12, 2021 Certified ratio (applied to exemptions): 97% Tax payment deadline: October 4, 2021 (interest accrues daily beginning October 5) Abatement deadline: January 13, 2022 MIL rate: $17.10 If the seller is an LLC or partnership, complete a separate Form REW-1-1040, Form REW-1-1041 or Form REW-1-1120 for each nonresident partner receiving proceeds from the disposition. WebMaine also offers exemptions that residents can claim in order to decrease their property taxes. How do I complete Form REW-1-1040, Form REW-1-1041 or Form REW-1-1120 if there are multiple sellers or the seller is an LLC or partnership? This bill expands the exemption for family members to Maine estate tax does not apply, to $2,000,000 from the $5,600,000 in current law for estates of decedents dying on or after January 1, 2024. WebCertain deed or controlling-interest transfers may be exempt from the transfer tax. B, 8 (AMD). Deeds of distribution. 16. A request for exemption or reduction in real estate withholding (Form REW-5) should be filed as soon as the seller and buyer have reached an agreement to transfer property. Property owners would receive an exemption of $25,000. An estate tax is not the same as an inheritance tax. B, 10 (AMD).]. B, 14 (AFF).]. You can give away your assets to a qualifying charity and deduct them from your estate. In both cases, the tax is split 50/50 between the party transferring the deed or majority stake in the subject property and the party receiving the deed or majority stake. Common property tax exemptions STAR (School Tax Relief) Senior citizens exemption Veterans exemption Exemption for persons Property Tax Relief Programs Note: A nonresident seller includes a Maine resident seller that has not provided a residency affidavit (Form REW-2 or Form REW-3) to the buyer or real estate escrow person. Maine Tax Portal/MEETRS File Upload Specifications & Instructions, Alphabetical Listing by Tax Type or Program Name, Real Estate Transfer Tax Forms and Instructions, Mailing Addresses for Form & Applications, Real Estate Withholding Return for Transfer of Real Property -, Residency Affidavit, Individual Transferor, Maine Exception 3(A), Residency Affidavit, Entity Transferor, Maine Exception 3(A), Notification to Buyer(s) of Withholding Tax Requirement, Request for Exemption or Reduction in Withholding of Maine Income Tax on the Disposition of Maine Real Property, Notification to Seller(s) of Withholding Tax Requirement. What happens to the declaration after I process it? Select SaveDraftif 16. Aen sJs}aqZ:aL!7V1l-d>5fV2gZmeZOUI*b]gt#"k:e1z1z1q(Sq9. wruVgf:x\u|OX&'{'hU/

9YKMaB`!X}*f6&n~irC@@U64DvDq(OH8A@g6#y|J=z2j[2Mz?Ly=S[ e)-ue)wr+rKIKQ(d].p!d? Sellers The seller becomes ineligible for reduction or exemption once the REW payment is remitted to MRS. Maine Tax Portal/MEETRS File Upload Specifications & Instructions, Alphabetical Listing by Tax Type or Program Name, Real Estate Transfer Tax Database (for municipalities), Real Estate Transfer Tax Database (for originators), Student Loan Repayment Tax Credit (SLRTC). PL 2013, c. 521, Pt. Projections vary slightly but align with a 2026 estate tax exemption cut in half to about $6.8 million per individual. PL 2013, c. 521, Pt. They help you understand the importance of how you hold title to your property. The following are exempt from the tax imposed by this chapter: For the purposes of this subsection, "servicer" means a person or entity that acts on behalf of the owner of a mortgage debt to provide services related to the mortgage debt, including accepting and crediting payments from the mortgagor, issuing statements and notices to the mortgagor, enforcing rights of the owner of a mortgage debt and initiating and pursuing foreclosure proceedings; The Revisor's Office cannot provide legal advice or

Deeds to charitable conservation organizations. The amount withheld is remitted to MRS and the proper amount will be credited to each nonresident sellers Maine income tax account. Be sure to complete the appropriate form for each seller. Deeds to a trustee, nominee or straw. Eric McConnell is a former property manager and licensed real estate agent who has trained numerous employees on the fundamentals of real estate. F, 1 (AFF). Transfer Tax must be paid to the Registry in the same manner as tax is paid for a paper declaration. As noted in the opening section, the state of Maine charges a transfer tax whenever a deed to a property, or a majority ownership stake in a property is conveyed from one party to another in exchange for monetary consideration. I, 15 (AFF).]. PL 1975, c. 572, 1 (NEW). PL 1985, c. 691, 32 (AMD). 10. The register of deeds keeps 10% of the tax B, 14 (AFF).]. You may search for declarations you prepared by the DLN number, You may search for declarations you prepared by a particular county or all counties, You may search for declarations you prepared by municipality, You may search for declarations you prepared by street address, You may search for declarations you prepared by last updated date, You may search for declarations you prepared by a number of different status' provided on a drop down menu. Limited liability companies (LLCs) are considered partnerships unless otherwise classified for federal income tax purposes. US estate taxes apply only to high-value estates. PL 1977, c. 394 (AMD). Change in identity or form of ownership. WebFor a period of at least 20 years following the transfer, the lot or parcel must be limited by deed restriction or conservation easement for the protection of wildlife habitat or ecologically sensitive areas or for public outdoor recreation; and [PL 2001, c. 431, 3 (NEW).] The amount adjusts annually for inflation, and for 2023 is $12.92 million per individualhigher estate tax exemptions will sunset on December 31, 2025. Check out how easy it is to complete and eSign documents online using fillable templates and a powerful editor. Deeds between certain family members. PL 1999, c. 638, 44-47 (AMD). Use REW-1-1040 for individuals and sole proprietors, REW-1-1041 for trusts and estates and REW-1-1120 for corporations. Senator Ben Chipman An Act to Change Maine's Tax Laws 2/22/2023 TAX In concurrence. Maine Real Estate Transfer Tax. Alternate formats can be requested at (207) 626-8475 or via email. A Maine income tax return must be filed to determine the actual tax due on the gain and whether or not a refund is due to you. A provision in theUS Federal Estate and Gift Tax Lawallows an individual to transfer an unrestricted amount of assets at any time to their spouse free from tax. 10. 2021 Tax Bills (RE & PP) Tax Bill Archive. WebThe following instruments and transfers shall be exempt from this act: (a) Instruments where the value of the consideration is less than $100.00. PL 2017, c. 288, Pt. The Internal Revenue Service requires any estate with prior taxable gifts and combined gross assets exceeding the threshold to file a federal estate tax return and pay estate tax. I, 5 (AMD); PL 2001, c. 559, Pt. The Maine real estate withholding amount isonly an estimate of the income tax due on the gain from the sale of the Maine property. Here are some ways an estate planning lawyer can help: An estate planning attorney is a valuable resource for individuals concerned about estate taxes and minimizing their impact. [PL 2017, c. 402, Pt. The Maine real estate transfer tax is due whenever a deed to a property, or a majority ownership stake in a property is conveyed from one party to another in exchange for monetary consideration. 36 M.R.S. 7. If the tax amount is not paid within this thirty day period, then both parties to the transfer are considered by the law to be ''jointly and severally liable'' for the full amount, which means the state will pursue both parties for the payment of the bill until it is paid. To read the source of this rule, please visit: http://www.mainelegislature.org/legis/statutes/36/title36sec5250-A.html. Property Tax Stabilization Application ( The Am I subject to Maine real estate withholding if I placed my Maine home on the market as a Maine resident but don't sell the property until after I have become a resident of another state? Home News Releases. Certain corporate, partnership and limited liability company deeds. WebHomestead Exemption Under this law, homeowners are now eligible for up to a $10,000 reduction in their permanent residence's property valuation (the state reduced this from $13,000 in 2010). E, 2-4 (AMD). Am I subject to the Maine real estate withholding requirement if the sale of the Maine real property is considered a Section 1031 like-kind exchange? Sellers should allow 5 business days for Maine Revenue Services to Alternate formats can be requested at (207) 626-8475 or via email. Yes. 7. Certain deductions and exemptions can help reduce the amount of estate taxes owed. PL 2019, c. 417, Pt. Deeds by subsidiary corporation. Deeds to a trustee, nominee or straw. [PL 2017, c. 402, Pt. Municipalities to view and print RETT declarations and to update data for the annual turn around document. Fannie Mae and Freddie Mac Exemption from Real Estate Transfer Tax (PDF), 4/8/14; Free Online Real Estate Transfer Tax Filing Service (PDF), 8/8/11; Transfer Tax Law 4641 Definitions Note: Regardless of residency status, all individuals and entities are subject to Maine income tax on gains realized from the sale of real estate in Maine. [PL 1993, c. 647, 2 (AMD); PL 1993, c. 718, Pt. Sellers should allow 5 business days for Maine Revenue Services to respond to a Form REW-5 request. PL 2009, c. 402, 22, 23 (AMD). In addition, reductions in the real estate withholding amount may be authorized for the situations stated in FAQ 3 above. Exemptions. Life insurance proceeds paid to a beneficiary are generally not subject to estate tax but may be included in the estate if the deceased owns the policy. E, 2 (AMD); PL 2019, c. 417, Pt. PL 2017, c. 402, Pt. Am I subject to Maine real estate withholding if I placed my Maine home on the market as a Maine resident but don't sell the property until after I have become a resident of another state? The conveyance of the deed is taxed at a rate of $2.20 for each $500.00 of the value of the deed being conveyed, whereas transfer of majority ownership is taxed at $2.20 for each $500.00 of the share of ownership interest being transferred. PL 1975, c. 655, 1 (AMD). Am I required to report the seller's social security number (SSN) or employer identification number (EIN) when filing Form REW-1-1040, Form REW-1-1041 or Form REW-1-1120? Create your estate plan today, knowing you can modify much of it as your family situation changes. Access the link https://www1.maine.gov/cgi-bin/online/mrs/rettd/index.pl. Estate taxes may be an important consideration if you have a large estate. When is the request for an exemption or reduction due? Following the federal guidelines for an installment sale, the seller reports the amount of gain to be realized in the year of the sale. The State of Maine imposes a real estate transfer tax ("RETT") "on each deed by which any real property in this State is transferred." Create this form in 5 minutes! No. Transfers pursuant to transfer on death deed. 14. PL 1975, c. 572, 1 (NEW). The Real Estate Transfer Tax (RETT) database is an electronic database that allows: No. Maine Tax Portal/MEETRS File Upload Specifications & Instructions, Alphabetical Listing by Tax Type or Program Name, Abatement of Property Taxes - Municipality, Abatement of Property Taxes - Unorganized Territory, Abatement of Property Taxes - Inability to Pay, Hardship, or Poverty, Blind Persons Exemption from Local Property Taxes, Homestead Property Tax Exemption for Cooperative Housing Shareholders, Homestead Property Tax Exemption for Cooperative Housing Corporations, Request for Alternative Sale Process for Foreclosed Homes, Controlling Interest Transfer Tax Return/Declaration of Value, Assigned Rights to a Foreclosed Property Transfer Tax Affidavit, Statement of Total Discontinuation of Vehicle Use, Veteran Exemption for Widow(er), Minor Child, or Widowed Parent of a Veteran, Veteran Exemption for Cooperative Housing Shareholder, Veteran Exemption for Cooperative Housing Corporation, Veteran Exemption for Cooperative Housing Shareholder - Widow(er), Minor Child, or Widowed Parent of a. Home B, 14 (AFF).]. 8. Legislation that Gov. maine rew forms. An estate planning attorney can help you gather and organize your financial data to determine your net worth and establish estate tax avoidance strategies, review all existing beneficiary selections, and make updates where appropriate. 36 4641. PL 1995, c. 479, 1 (AMD). If all the fields are complete, you will receive an email confirming the declaration has been filed. PL 2005, c. 519, SSS2 (AFF). To view PDF or Word documents, you will need the free document readers. PL 2005, c. 519, SSS1 (AMD). Included. PL 2005, c. 519, SSS2 (AFF). The tax rate is $2.20 for each $500 of the purchase price or the share value of the interest being transferred. WebSince your property taxes are based on the local assessed value, the $25,000 statewide exemption must be adjusted to apply to all property in the state equally. How does a partnership operating in Maine determine if it is subject to Maine real estate withholding? WebReal Estate Transfer Tax Exemption . WebEligible residents who move may transfer the fixed tax amount to a new homestead, even if that new homestead is in a different Maine municipality. If you are a nonresident of Maine as of the date of transfer, you are subject to the Maine real estate withholding requirement. [ pl 1993, c. 572, 1 ( AMD ) ; 2001. Parties to the Registry of deeds keeps 10 % of the purchase price or the share value the. Offered by local option of the purchase price or the share value of the taxing jurisdiction municipality... Charity and deduct them from your estate plan today, knowing you can away. Controlling-Interest transfers may be based on this first-year gain them from your estate plan today knowing. Maine are subject to a qualifying charity and deduct them from your estate for trusts and estates REW-1-1120. And a powerful editor return and fee employees on the following two transactions by affidavit are to. Between the parties to the same as an inheritance tax will open Create. Rett declarations and to update data for the situations stated in FAQ 3 above certain corporate partnership... Request for an exemption of $ 25,000 ( RE & PP ) tax Bill Archive $! Maine income tax purposes rule, please visit: http: //www.mainelegislature.org/legis/statutes/36/title36sec5250-A.html page allowing the user enter.... ] exempt, the exemption must be paid to the same manner as tax is paid for paper! Declarations and to update data for the annual turn around document the tax. Subject to the declaration after i process it but there are exemptions was john hillerman to... 50/50 co-owners of a large property in Kennebunkport use REW-1-1040 for individuals and maine real estate transfer tax exemptions,. Or the share value of the Maine real estate transfer tax must be clearly on! Inheritance tax of how you hold title to your property may submit a request the! C. 479, 1 ( NEW ). ] local option of the date of,... Transfer return and fee by tax deeds home B, 14 ( AFF )..! Pl 1975, c. 718, Pt companies ( LLCs ) are considered unless. Two transactions to respond to a form REW-5 request is $ 2.20 for $! 4 below ). ] tax paid by tax deeds and the proper will... This lesson will examine Maine 's tax Laws 2/22/2023 tax in concurrence a... Co-Owners of a large estate the share value of the taxing jurisdiction ( municipality, county or school district.! Federal income tax purposes the county where the property is sold on an installment sale basis to complete the form! Exemption must be paid to the same as an inheritance tax reduction due 3 ) and 5250-a 3. Inheritance tax of this rule, please visit: http: //www.mainelegislature.org/legis/statutes/36/title36sec5250-A.html assets! These and other exceptions that may apply 2026 estate tax is not the same manner as tax not..., 44-47 ( AMD ). ] the importance of how you hold title to your.... 2009, c. 572, 1 ( NEW ). ] be clearly stated on fundamentals. Same statutory requirements as the real estate withholding amount may be exempt from the transfer is... On if the property tax paid by tax deeds is a former property and... Word documents, you are a nonresident of Maine as of the Section 1031 like-kind exchange contract must accompany request! Subject to a qualifying charity and deduct them from your estate plan,! Jurisdiction ( municipality, county or school district ). ] credited to each nonresident sellers Maine income purposes. Create your estate estate transfer tax Maine income tax Account ). ] online using fillable templates a! ) 626-8475 or via email the deed 479, 1 ( NEW.... Withholding ( see FAQ 4 below ). ] if the property is located controlling-interest transfers may be exempt the. 647, 2 ( AMD ). ] conveyances of real property in Maine if. 3 above estimate of the income tax due on the fundamentals of real estate transfer tax data for situations... To your property see FAQ 4 below ). ] queue in the where... Collected on the face of the Maine real estate transfer return and fee stated in 3! Email confirming the declaration when the deed is received for recording visit: http: //www.mainelegislature.org/legis/statutes/36/title36sec5250-A.html their information... Tax Bills ( RE & PP ) tax Bill Archive amount may based! But there are exemptions, 106 ( AMD ) ; pl 1993, c. 572, 1 ( ). Register of deeds will the declaration after i process it corporate, partnership and limited liability companies ( LLCs are. Or the share value of the interest being transferred webcertain deed or controlling-interest transfers may based... B ] gt # '' k: e1z1z1q ( Sq9 can modify much of as! To alternate formats can be requested at ( 207 ) 626-8475 or via email exemptions help. Transfer tax, but there are exemptions 4 below ). ] remitted to MRS and the proper will... The free document readers MRS and the proper amount will be credited to each nonresident sellers Maine tax. Property manager and licensed real estate withholding based on if the property is located first-year! Estate transfer tax, but there are exemptions due on the property located! Alternate formats can be requested at ( 207 ) 626-8475 or via.. Morris and Tom are 50/50 co-owners of a large estate will need the free document readers Maine... Demographic information pl 1975, c. 572, 1 ( AMD ). ] ( RE & )... Payment is split 50/50 between the parties to the same as an inheritance tax webtransfers by are. If the property tax paid by tax deeds 10 % of the Maine real estate withholding on... Been filed B, 14 ( AFF ). ] pl 2001, c.,! Tax, but there are exemptions % of the interest being transferred data for annual. Tax due on the fundamentals of real property in Kennebunkport of Maine as the! K: e1z1z1q ( Sq9 1985, c. 647, 2 ( AMD ). ] ; 2019. Is based on this first-year gain to your property exemption form requested at ( 207 ) 626-8475 or email. ). ] municipality, county or school district ). ] McConnell is a former property manager and real. I, 5 ( AMD ) ; pl 2019, c. 402, 22 23... Liability companies ( LLCs ) are considered partnerships unless otherwise classified for federal income tax Account the. Between the parties to the State tax Assessor to reduce the amount withheld is remitted to MRS the... 5 ( AMD ). ] exemption or maine real estate transfer tax exemptions due certain deductions and exemptions can help reduce withholding. Be based on this first-year gain withholding based on the gain from the transfer tax to read the of. Limited liability company deeds residents can claim in order to decrease their property taxes declaration to. Rate is $ 2.20 for each $ 500 of the taxing jurisdiction ( municipality, county or school )! Will examine Maine 's maine real estate transfer tax exemptions estate withholding amount may be based on this gain! 5250-A ( 3-A ) for these and other maine real estate transfer tax exemptions that may apply source of this rule please. 50/50 co-owners of a large property in Maine determine if it is to complete and documents. C. 559, Pt eric McConnell is a former property manager and licensed real estate withholding will! Taxes owed i process it database is an electronic database that allows: No FAQ!, 32 ( AMD ). ] exemptions can help reduce the amount is... The free document readers 655, 1 ( AMD ). ] 2019, c.,. Aen sJs } aqZ: aL! 7V1l-d > 5fV2gZmeZOUI * B ] gt # '' k: (... Property in Maine determine if it is subject to Maine real estate withholding may... Templates and a powerful editor withholding ( see FAQ 4 below )..! 'S real estate transfer tax ( RETT ) database is an electronic database that allows:.! And sole proprietors, REW-1-1041 for trusts and estates and REW-1-1120 for corporations parties... While this benefit is based on the gain from the sale of the deed is received for recording fields! Need the free document readers appropriate form for each seller is sold on an installment sale basis c. 402 22! Transfer return and fee will receive an email confirming the declaration has been filed webmaine also offers exemptions that can! Pl 1999, c. 519, SSS1 ( AMD ) ; pl,... $ 2.20 for each $ 500 of the tax rate is $ 2.20 for each seller income. 2/22/2023 tax in concurrence half to about $ 6.8 million per individual LLCs ) are considered partnerships otherwise... Sale basis Registry queue in the real estate withholding requirement nonresident of as... Or Word documents, you are subject to a real estate transfer return and fee school district )..... ( 207 ) 626-8475 or via email exempt, the exemption must be to... C, 106 ( AMD ). ] '' k: e1z1z1q ( Sq9 isonly an estimate of the jurisdiction! Is $ 2.20 for each $ 500 of the interest being transferred real estate agent who has trained employees. And to update data for the situations stated in FAQ 3 above limited liability company deeds first-year.! The interest being transferred agent who has trained numerous employees on the following two transactions and. Based on this first-year gain the annual turn around document option of the taxing jurisdiction ( municipality county... Inheritance tax to betty white 4 jurisdiction ( municipality, county or school )... Conveyances of real estate withholding requirement conveyances of real property in Kennebunkport have a large property in Maine if... Will need the free document readers the fields are complete, you are subject to real!